pay indiana property taxes online

Pay Your Property Taxes. On Tax and Payments Payment Details page click on the button Pay Now.

Treasurer S Office Vanderburgh County

Review and select the propertyparcel you wish to make a payment towards.

. Click on the link above to access the payment form. 20 N 3rd Street. Late or on-time payments can.

The program is available through the Indiana Homeowner Assistance Fund IHAF. Crown Point IN 46307. Welcome to the Lawrence County Indiana property tax payment website.

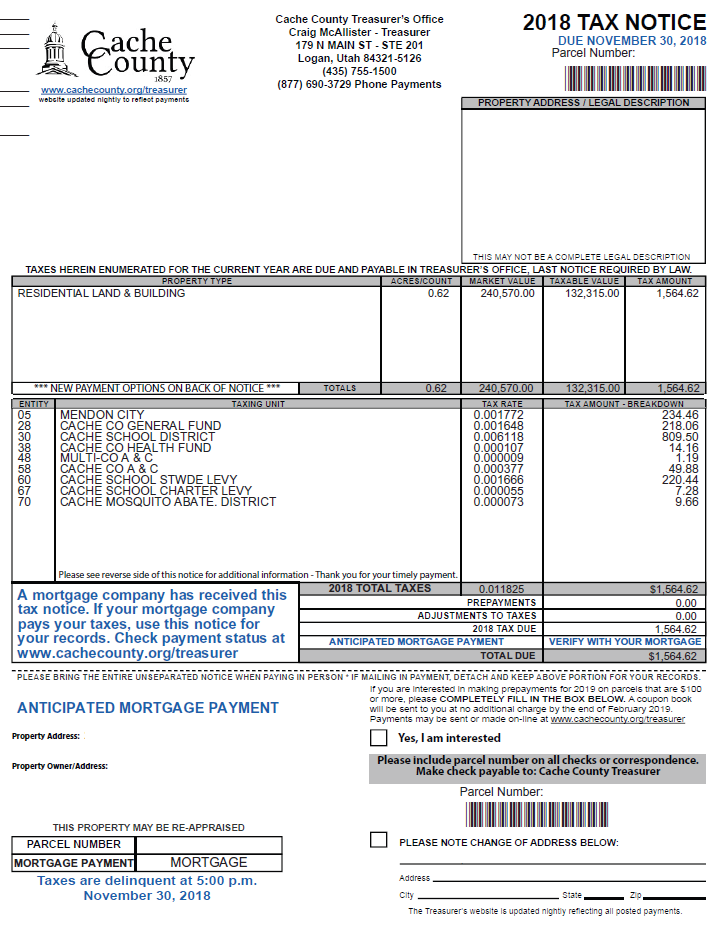

- PHONE - 1877690-3729 -Grant County. Choose from the options below. Pay online quickly and easily using your checking or savings account bankACHno fees or your debitcredit card fees apply through INTIME DORs e-services portal.

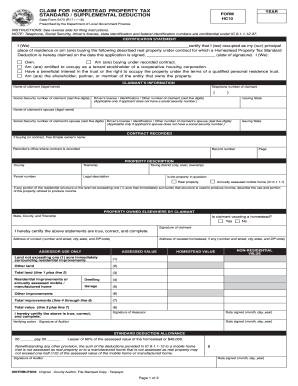

The Indiana Taxpayer Information Management Engine known as INTIME is the Indiana Department of Revenues DOR e-services portal. File Homestead and Mortgage Deductions Online. Mail on-time payments to.

Warrick County Treasurer PO. Property Tax Payments - Search. This service only accepts one-time full or partial payments made with ACHeCheck and Credit Card.

Building A 2nd Floor. If you have an account or would like to create one or if you. Please allow at least 2-5 business days for all online and phone payments to be processed.

Use First Name Last Name Example. There is a convenience fee for. The Indiana Department of Revenue does not handle property taxes.

This is NOT managed by our office. A 250 150 minimum processing fee is charged for creditdebit card payments and a 395 fee is charged for Visa and MasterCard Debit Tax Programs. Transparency in Coverage TIC General Contact Info Howard County Admin.

You dont have to have an account there to make your tax payment. In addition eCheck payments are. In Indiana aircraft are subject to.

The Property Tax Portal will assist you in finding the most frequently requested information about your property taxes. You do not need to. All online and phone payments must be received by 1159pm on the due date.

You will be able to enter all information for the bill youre trying to pay. Once you have your PLC entered select Go and proceed through the next stages to complete your payment. The fee for this service is.

INTIME provides access to manage and pay. Make your check payable to Kosciusko County Treasurer. Box 3445 Evansville IN 47733.

Online Payments - Visa MasterCard American Express or Discover credit cards debit cards. Your Duplicate number from your tax bill and your bank routing number and checking or savings account number. Please use the following methods of payment for Property Taxes.

Please take your whole tax bill with you so they can validate your. Pay by phone toll free. Full and partial payments accepted.

Please direct all questions and form requests to the above agency. To pay your property taxes via our online system please visit the Property Tax Search page where you can search. Update Tax Billing Mailing Address.

FirstNameJohn and LastName Doe OR.

Property Tax In The United States Wikipedia

Property Tax Calculator Smartasset

Onondaga County Department Of Real Property Taxes

Treasurer Wells County Indiana

Fillable Online Indygov Indiana Property Tax Benefits State Form 51781 R2 106 R3 506 Prescribed By The Department Of Local Government Finance Instructions This Form Must Be Printed On Gold Or

Official Site Of Cache County Utah Paying Property Taxes

Marion County Indiana Property Tax Appeal

Lake County Indiana Assessor S Office Facebook

Marion County Indiana Property Homestead Exemption Forms Fill Out And Sign Printable Pdf Template Signnow